US faces shortages of various major consumer goods like chicken, gas, lumber and microchips in post-pandemic economy

10/16/2021 / By Zoey Sky

As America and the rest of the world continues to resume normal operations after the coronavirus (COVID-19) pandemic, businesses across the country struggle to acquire major consumer goods like chicken, lumber and microchips.

The pandemic also resulted in countless reports of shortages across the supply chain, from shipping, demand, supply and other levels of the global economy.

Food supplies: Chicken and ketchup

Chicken

Food supplies have been fluctuating since the pandemic began but the fast food industry is partly to blame for the “fried chicken sandwich wars” that began back in 2019.

In 2019, Popeyes and Chick-fil-A both released chicken sandwiches that were a hit with customers.

Popeyes first announced a chicken sandwich in August 2019. The sandwich sparked the chicken sandwich wars among fast-food chains, particularly with Chick-fil-A, which claims to have pioneered the “original chicken sandwich.”

On Feb. 24 of this year, McDonald’s launched a trio of new chicken sandwiches. KFC also rejoined the chicken wars this year by launching the new KFC Chicken Sandwich.

Unfortunately, the fried chicken wars are putting a strain on the already struggling poultry population. Major chains like KFC and Wingstop are paying more for chicken and suppliers can’t always meet demand because it’s harder to attract workers.

Meanwhile, other restaurants removed chicken tenders and Nashville Hot flavored chicken items from menus because of the limited supply.

Ketchup

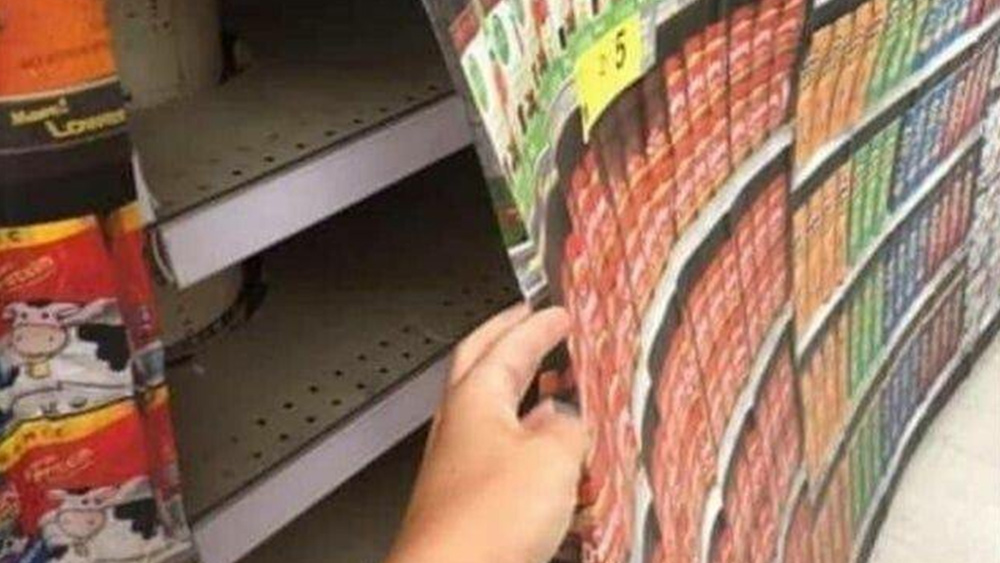

The pandemic has also caused a shortage of ketchup, one of the most popular condiments in America. Restaurants are gradually recovering from major losses in the early days of the pandemic but the restaurant industry is now struggling to get ahold of ketchup packets that are in demand because of the boom in food deliveries and takeouts.

Kraft Heinz, America’s number one ketchup producer, is struggling to keep up with the increasing demand for ketchup packets. Heinz’s Tomato Ketchup has always been in demand even before the pandemic but now restaurants need more single-serve ketchup packets to address customer needs.

Demand for ketchup packets also increased after the Centers for Disease Control and Prevention (CDC) told restaurants to stop using shared condiment bottles from their dining rooms amind the pandemic.

Kraft Heinz reported that it would increase production by 25 percent to address the increased demand.

Shortage of other materials like chlorine, computer chips, gas, lumber and metals

Chlorine

Swimming pool owners also had a hard time getting ahold of supplies because of nationwide chlorine shortages.

The chlorine shortage was linked to a fire at a chemical plant in Louisiana last August. The plant was damaged by Hurricane Laura.

Prices for chlorine supplies have also increased significantly due to the shortage. The extent of the chlorine shortage remains unknown.

Computer chips

Anyone looking for a new phone or washing machine will either have to wait or spend more due to a shortage of computer chips.

Manufacturers across the globe struggle to secure supplies of semiconductors, which then delays the production and delivery of goods. The shortage also threatens to increase product prices.

Different factors were linked to the shortage, which first affected the auto industry. The pandemic plunged the global economy into recession in 2020, upended supply chains and drastically changed consumer shopping patterns.

Carmakers eased up on orders for computer chips while tech companies, whose products were in demand due to remote work arrangements and lockdowns, cleaned out supplies.

Now the shortage is affecting everything from cars to consumer electronics. According to analysts, the computer chip shortage might last throughout the rest of 2021 since the bulk of chip production is concentrated in a handful of suppliers.

Gas

The National Tank Truck Carriers report that at least a quarter of all tank trucks in the country that carry gas are parked because of a shortage of drivers. If you’ve been planning to go on a post-pandemic vacation this summer, you might have to rethink your plans due to the gas shortage.

While there’s no shortage of crude oil or gasoline, there aren’t enough tanker truck drivers to meet the demand for gas. At least 20 to 25 percent of tank trucks in the fleet are parked as summer begins due to the lack of qualified drivers.

Ryan Streblow, the executive vice president of the NTTC, explained that the driver shortage was already an issue and that the pandemic aggravated the problem. The national average price of regular gas is at an average of $2.94 a gallon, which is already up by over 60 percent compared to 2020 when prices and demand were bottoming out. Experts say that the national average could surpass $3 a gallon this summer.

Prices could increase more if hurricanes hit the Gulf Coast or if there are other disruptions to supply like a refinery fire.

Lumber

Increasing wood prices are also making toilet paper more expensive. When the coronavirus pandemic affected the economy last spring, sawmills shut down lumber production to prepare for a housing slump.

While the slump never arrived, now there isn’t enough lumber to meet the demand from the hot housing market. Because of the shortage, the construction of badly needed new homes is being delayed. The supply issue is also complicating renovations of existing homes.

Fortunately, industry executives expect lumber production to gradually catch up with demand. Samuel Burman, an assistant commodities economist, noted that there will be a “sharp fall” in lumber prices over the next 18 months.

Metals

As more countries switch to green energy, the demand for metals like cobalt, copper, lithium, nickel and rare earth elements are also skyrocketing.

Back in May, the International Energy Agency (IEA) warned through a report that these metals “are all vulnerable to price volatility and shortages” since “their supply chains are opaque, the quality of available deposits is declining and mining companies face stricter environmental and social standards.”

Limited access to known mineral deposits is another risk factor. Three countries control over 75 percent of the global output of lithium, cobalt and rare earth elements.

- In 2019, the Democratic Republic of Congo was responsible for 70 percent of cobalt production.

- Meanwhile, China produced 60 percent of rare earth elements while refining 50 percent to 70 percent of both lithium and cobalt and almost 90 percent of rare earth elements. (Related: Extended global supply shortage seen as China’s factories squeezed.)

- Australia also controls the output of these metals.

Mining companies would have responded to higher demand by increasing investment in new projects. However, it takes on average 16 years from the discovery of a deposit for a mine to start production, concluded the IEA.

Visit FoodSupply.news for more updates on shortages on food and other major consumer goods.

Sources include:

Tagged Under: chaos, Collapse, consumer goods, coronavirus, covid-19, economy, global economy, material shortages, pandemic, post-pandemic recovery, raw materials, semiconductor shortage, shortage, shortages, supply chain, supply chains, supply shortages

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 FOOD COLLAPSE