Coronavirus shutdowns causing food prices to soar

04/28/2021 / By Ethan Huff

A handful of the world’s most important commodities – these include corn, wheat, soybeans, and vegetable oils – are skyrocketing in price, thanks to the economic shutdowns imposed in response to the Wuhan coronavirus (Covid-19).

This week’s Bloomberg Agriculture Spot Index, which tracks key farm products, shows a nine-year record surge in price for these commodities. Global food prices are already the highest they have been since mid-2014, which is being driven in part by a rally in crop futures.

Staple food crops like the aforementioned are used not just to feed people and cattle, by the way. Some of them, including corn, are also used for fuel in the form of ethanol, which means gas prices may also continue their surge.

“Soaring raw material prices have broad repercussions for households and businesses, and threaten a world economy trying to recover from the damage of the coronavirus pandemic,” reports Bloomberg.

“They help fuel food inflation, bringing more pain for families that are already grappling with financial pressure from the loss of jobs or incomes.”

United Nations Food and Agriculture Organization (FA) senior economist Abdolreza Abbassian revealed in an interview that a “bullish force” is behind these price increases, which are occurring internationally.

“The indications are that there is very little reason to believe prices would remain at these levels,” he says. “It’s more likely they will rise further. Hardship is still ahead.”

Speculative greed and endless money printing will cause billions to starve

The federal government’s endless money printing is not helping matters, either. Rapid inflation is weakening the U.S. dollar to the point that food costs are rising regardless of how the markets are behaving.

All that “stimulus” money is also being pumped into the markets, allowing investors to speculate on food commodities and drive up their prices. All of these market forces are creating a hyperinflationary environment that is very concerning, especially for the already struggling lower and middle classes.

“For central banks, a spike in prices at a time of weak growth creates an unwelcome policy choice and could limit their ability to loosen policy,” Bloomberg claims.

The poorest and most politically unstable nations of the world are being hit hardest by the spike, as any significant volatility in raw materials prices threatens to make millions, if not billions, go hungry.

“The relentless rise in prices acts as a misery multiplier, driving millions deeper into hunger and desperation,” says Chris Nikoi, the World Food Programme’s regional director for West Africa, which is one of the poorest areas in the world.

It’s “pushing a basic meal beyond the reach of millions of poor families who were already struggling to get by,” he added.

Another factor driving higher food prices is increased demand from communist China for food imports. Corn prices nearly doubled last year because of China, while soybean prices and wheat prices increased by 80 percent and 30 percent, respectively.

Bad weather conditions in both the U.S. and Brazil, two major areas where crops are grown, are likewise exacerbating the problem. Analysists from Rabobank, Mintec, and HSBC Global Research all warn that prices could go even higher if the situation is not resolved somehow.

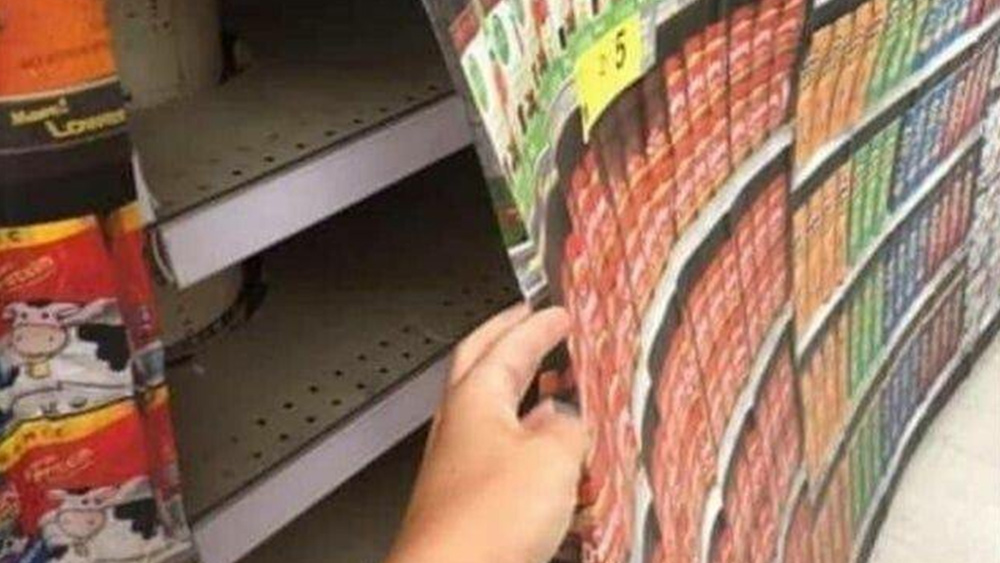

The effects of all this are already being seen in the form of higher prices for tortillas in Mexico, beef in Brazil and retail palm oil in Myanmar. Here in the U.S., bacon and other meat cuts are also on the rise.

“Generally, people see this inflation continuing,” says Tosin Jack, an analyst at Mintec, which monitors commodity prices. “The trend will continue for some time and it will translate into consumer goods.”

More of the latest news about the impending global “reset,” which the deep state will use to usher in the new world order, can be found at Collapse.news.

Sources for this article include:

Tagged Under: commodities, corn, economic collapse, food prices, great reset, Inflation, markets, new world order, Soybeans, speculation, vegetable oils, wheat

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 FOOD COLLAPSE